Posted on: November 25, 2023, 09:08h.

Last updated on: November 25, 2023, 09:11h.

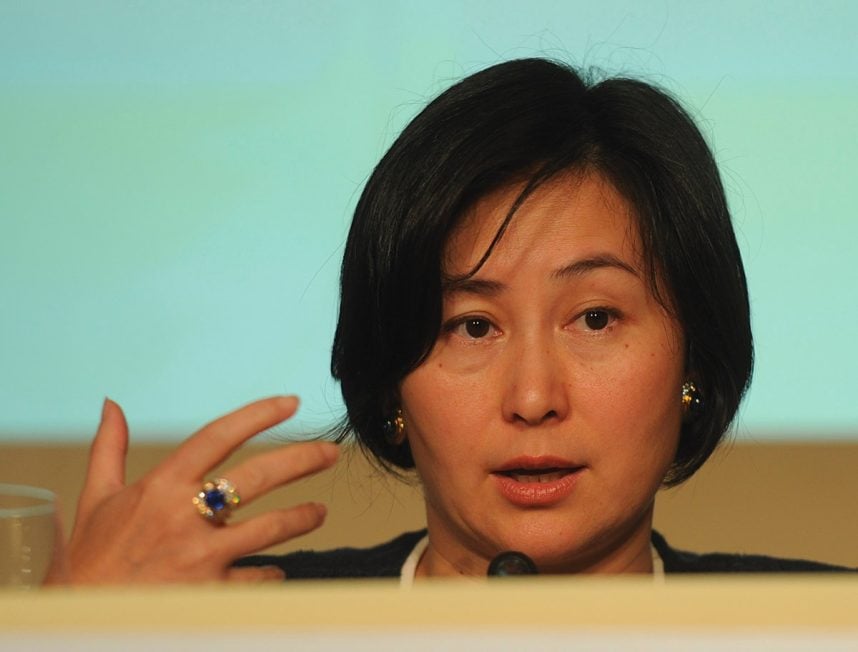

Pansy Ho, co-chairperson at MGM China, is unlikely to materially alter her stake in the gaming company despite a recent move that suggests otherwise.

Ho, Macau casino patriarch Stanley Ho’s eldest daughter, recently deposited the entirety of her equity interest in MGM China — 380 million shares to be exact — into the Hong Kong Exchange’s Central Clearing and Settlement System (CCASS). The CCASS was implemented by the Hong Kong Securities Clearing Company Limited (HKSCC) to add more efficiency to and reduce settlement times for large block trades.

China Connect Securities Trades follow the settlement cycle of the Mainland stock market, where stock is settled on T-day and money is settled on T+1 day,” according to Hong Kong Exchanges and Clearing. “The stock exchange of Hong Kong (SEHK) transmits details of China Connect Securities Trades directly from its order routing system, China Stock Connect System (CSC) to CCASS in real-time. HKSCC reconciles the provisional clearing data files retrieved from ChinaClear’s system against the trade records from SEHK. Final Clearing Statements are available to related Participants shortly after 16:00 hours on T day.”

Ho is also managing director and a 15% owner of MGM Grand Paradise, the entity that holds the license for MGM China’s two Macau integrated resorts.

MGM China Questions Moves

Various Asian media outlets reported that Ho recently made two transactions — one via BNP Paribas and the other through Standard Chartered — to move her MGM China shares into the CCASS, but MGM China said it wasn’t directly involved with the transactions.

Rather, the MGM Cotai operator said the moves were part of previously made arrangements between Ho and her banks. Ho, 61, cleared $1.5 billion from MGM China’s 2011 initial public offering (IPO). She’s largest individual shareholder of the gaming company’s equity and doesn’t have an established track record of massive sales of the stock.

While she’s mostly held onto her MGM China shares, Ho started trimming her stake in MGM Resorts International (NYSE: MGM) in 2019 and today owns just a fraction of what was previously a large position.

Ho became a significant MGM shareholder in 2016 when the Las Vegas-based gaming company boosted its stake in MGM China to roughly 56%.

Not a Good Time for Pansy Ho to Sell

Even if the aforementioned move of her MGM China stock to the CCASS was a prelude to a sale, Ho could be making a mistake because Macau casino stocks have recently slumped. Earlier this month, shares of five of the six concessionaires — MGM China was the exception — touched the lowest levels since early 2022.

That indicates that any investor cutting or eliminating such positions today may be “selling low.” It’s likely just coincidence, but Ho’s track record of selling MGM shares indicates she rarely commits the offense of selling.

Additionally, Macau casino stocks are historically inexpensive, indicating valuation risk has been eliminated from the equation.