Super Micro Computer (NASDAQ: SMCI) stock lost substantial ground in Monday’s trading. The company’s share price closed out the daily session down 6.4% according to data from S&P Global Market Intelligence. Notably, the pullback happened even as the S&P 500 index climbed roughly 0.8%.

Supermicro stock was added to the S&P 500 today, replacing Whirlpool in the benchmark index. The move was announced on March 4, and the server specialist’s stock posted explosive gains on the news. Even with today’s pullback, Supermicro’s share price is still up roughly 11% since it was announced that the company was being added to the index.

Being included in the S&P 500 index is often a bullish sign for a stock. Once a company becomes part of the S&P 500, investors who purchase exchange-traded funds (ETFs) that track the index will also effectively be buying shares of that company’s stock. In turn, that tends to increase demand and send its share price higher. Being part of the S&P 500 is also a prestigious distinction, and it can bolster the appeal of a still relatively little-known company, such as Supermicro.

But in this case, it looks like some investors got overly excited about the short-term pricing impact that actually being added to the index would have. While the stock had actually been up as much as 7.4% early in the day’s trading, many shareholders moved to take profits shortly after the market opened.

Is Supermicro stock still a smart buy?

Even with today’s sell-off, Supermicro has been one of this year’s best performing artificial intelligence (AI) stocks. The company’s share price has rocketed roughly 252% higher across 2024’s trading thanks to AI-driven demand for its high-performance rack servers.

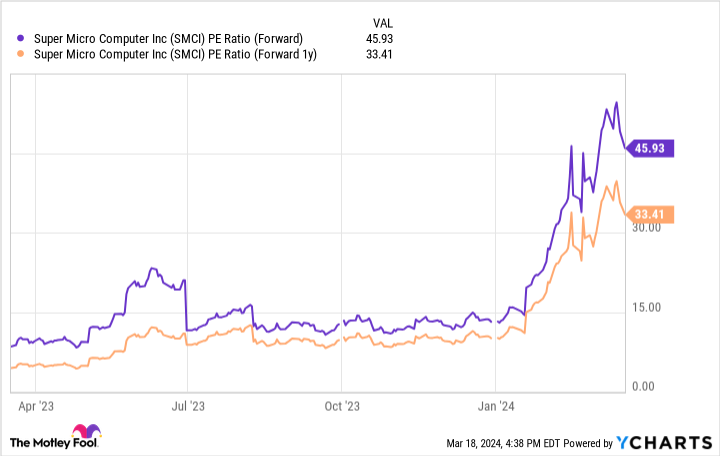

Supermicro stock is now trading at roughly 46 times this year’s expected earnings and a bit under 33.5 times next year’s expected profits. Meanwhile, the company has a forward price-to-earnings growth (PEG) ratio of roughly 0.5 and a one-year forward PEG of roughly 0.6. Typically, a PEG of less than one is viewed as an indication that a stock is undervalued.

Based on the company’s recent sales and earnings growth and the emergence of AI-related tailwinds, it’s not unreasonable to think that Supermicro stock can still deliver big wins over the long term. But investors should approach the stock with the understanding that near-term performance could be bumpy on the heels of such explosive growth. With that in mind, taking a dollar-cost-averaging approach to the stock looks like a sensible strategy for bulls right now.

Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of March 18, 2024

Keith Noonan has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Super Micro Computer Fell After Being Added to the S&P 500 Today — Is This a Chance to Buy the AI Stock? was originally published by The Motley Fool