(Bloomberg) — A renewed bout of volatility gripped stocks in the final stretch of May as the world’s largest technology firms got hit, underperforming the rest of the market.

Most Read from Bloomberg

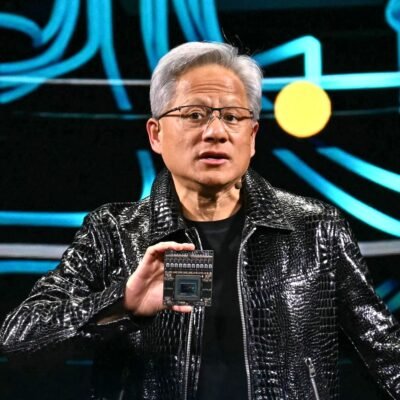

Megacaps like Nvidia Corp. and Microsoft Corp. took a hit Friday, extending a slide this week that was partly driven by underwhelming results from Dell Technologies Inc. and Salesforce Inc. Investors betting that tech behemoths will continue to power gains could be in for a rough ride when other sectors start to catch up, according to strategists at Bank of America Corp. — who said the outperformance of value over growth as market breadth improves could be the next “pain trade.”

“Leaders to losers… for now,” said Dan Wantrobski at Janney Montgomery Scott. “We are seeing breaks of initial support in some leadership areas. Net-net we are still expecting a bumpy ride for US equities as we enter the month of June.”

Meantime, Treasuries extended gains at the end of their best month in 2024 as the core personal consumption expenditures price gauge came in line with estimates, while posting the smallest increase this year. What’s more, spending unexpectedly dropped. For a data-dependent Fed, the report was seen by traders as “not quite as bad”, “slightly constructive” and “marginally dovish.”

“While we don’t necessarily want to see a weakening consumer, softening retail spending should help stoke the flames for lower rates in the second half of 2024,” said Bret Kenwell at eToro. “We’re not there yet, but the inflation reports were a constructive first step.”

The S&P 500 briefly broke below 5,200, but was still poised for its biggest monthly gain since February. The Nasdaq 100 slid over 1%. US 10-year yields fell four basis points to 4.51%. The dollar fluctuated.

“Technology shares now appear overextended, suggesting a correction may be on the horizon,” said Fawad Razaqzada at City Index and Forex.com. “After months of substantial gains and no new bullish catalysts, a correction wouldn’t be surprising.”

Hedge funds’ exposure to US technology behemoths hit a record high following Nvidia Corp.’s estimate-thumping earnings report this month, according to a recent report from Goldman Sachs Group Inc.’s prime brokerage.

The so-called Magnificent Seven companies — Nvidia, Apple Inc., Amazon.com Inc., Meta Platforms Inc., Alphabet Inc., Tesla Inc. and Microsoft — now account for about 20.7% of hedge funds’ total net exposure to US single stocks, the report showed.

Matt Maley at Miller Tabak says that usually, when we get some “rotation” in the stock market, that’s viewed as a positive development. However, since the rotation between tech and everything else has gone in both directions over the past two weeks, he views it as a negative development.

“In other words, the kind of ‘rotation’ we’ve seen recently can be viewed as ‘churning,” he said. “This is not negative in-and-by-itself, but when it comes after a nice rally, it tends to indicate that the advance is becoming tired. Thus, it is frequently followed by some sort of a pullback — even if it’s only a mild one.”

Aside from the tech slide, traders also waded through the latest inflation report.

The so-called core PCE, which strips out the volatile food and energy components, increased 0.2% from the prior month. Inflation-adjusted consumer spending unexpectedly fell 0.1%, dragged down by a decrease in outlays for goods and softer services spending. Wage growth, the primary fuel for demand, moderated.

“Markets see inflation on a slow, but steady path lower,” said Quincy Krosby at LPL Financial. “The question is still how much more the Fed needs in terms of slower inflation before initiating an easing cycle.”

Overnight index swap contracts tied to upcoming Fed policy meetings continue to fully price in a quarter-point rate cut in December, with the odds of a move as soon as September edging up to around 50%. For all of 2024, the contracts imply a total of 34 basis points of rate reductions, up slightly from the close on Thursday.

While the PCE data will likely be welcomed by the Fed, the core gauge has still risen at an annualized rate of 3.5% in the last three months, according to David Donabedian at CIBC Private Wealth.

“So, it’s way too early for any sort of victory lap for the Fed,” he noted.

In fact, inflation may not return to the US central bank’s 2% target until mid-2027, according to research from Fed Bank of Cleveland.

That’s because the inflationary impacts of pandemic-era shocks have largely resolved and the remaining forces that are keeping inflation elevated are “very persistent,” Cleveland Fed economist Randal Verbrugge wrote in a report Thursday.

Another aspect is that consumer spending in the first month of the new quarter slowed as real disposable incomes fell, remarked Jeff Roach at LPL Financial.

“Businesses need to prepare for an environment where consumers are not splurging like they were last year,” he noted.

“We are in a be-careful-what-you-wish-for moment because if slowing consumer spending leads to lower inflation and the Fed is able to cut slowly as a result then that will be good for markets,” said Chris Zaccarelli at Independent Advisor Alliance.

“If slowing consumer spending leads to lower inflation and the Fed is able to cut slowly as a result then that will be good for markets,” he said. “However, if consumer spending – and the economy – slows too quickly then corporate profits and stock prices will go down much more quickly than the Fed will be able to cut rates, so we would be careful at this point.”

Wall Street Reacts to Inflation Data:

Investors have been hoping that the bout of inflation we saw early in the year would fade, and that seems to be playing out.

The PCE data confirms price increases aren’t as sticky as feared, keeping hopes of at least one rate cut on the table.

April PCE data was a welcome relief after a string of hotter than expected inflation data in Q1, with headline and core inflation coming in as expected.

So the overall inflation outlook looks good, with disinflation in the pipeline, and that likely keeps the Fed on track to cut twice this year starting in September.

Yields fell in response to the PCE data only because there was no surprise with the data in line. Maybe too with the slightly less than expected spending figure as REAL spending was down a touch.

Overall, the April PCE report is marginally dovish. We needed to see more progress in disinflation to argue for multiple rate cuts in 2024.

Good news, right? Not quite. April inflation was better than March; still not good enough.

Inflation progress in April was not yet good enough to start the clock on the three month-type downshift we think is needed for the Fed to cut.

Corporate Highlights:

-

Carl Icahn has amassed a sizable position in Caesars Entertainment Inc., according to people familiar with the matter, raising the prospect of a fresh tussle with the US hotel and casino operator.

-

Hedge-fund manager Bill Ackman is selling a stake in Pershing Square as a prelude to a planned initial public offering of his investment firm, according to a person familiar with the matter.

-

Gap Inc. reported better-than-expected results and raised its outlook for the full year, showing the apparel retailer’s bid to rebuild the business is moving forward.

-

Penn Entertainment Inc. soared after an activist investor called for the sale of the casino company, saying a failed deal and growing pattern of guidance misses have damaged management’s credibility.

-

Moderna Inc. gained US approval for its RSV vaccine in older adults, giving the biotech company a second product as it seeks to move beyond its reliance on the fading market for Covid-19 shots.

-

Hess Corp. shareholders approved the company’s proposal to be acquired by Chevron Corp. for $53 billion by a razor-thin majority of 51% of shares outstanding.

—————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————-

Some of the main moves in markets:

Stocks

-

The S&P 500 fell 0.1% as of 3:15 p.m. New York time

-

The Nasdaq 100 fell 1.1%

-

The Dow Jones Industrial Average rose 0.7%

-

The MSCI World Index was little changed

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro was little changed at $1.0842

-

The British pound was little changed at $1.2731

-

The Japanese yen fell 0.3% to 157.26 per dollar

Cryptocurrencies

-

Bitcoin fell 1.7% to $67,313.15

-

Ether rose 1% to $3,776.27

Bonds

-

The yield on 10-year Treasuries declined four basis points to 4.51%

-

Germany’s 10-year yield advanced one basis point to 2.66%

-

Britain’s 10-year yield declined three basis points to 4.32%

Commodities

-

West Texas Intermediate crude fell 1.1% to $77.09 a barrel

-

Spot gold fell 0.9% to $2,321.45 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Sagarika Jaisinghani.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.